Businesses lose billions due to poor demand forecasting - $818 billion from inventory distortions last year alone. Historical data is the key to fixing this.

By analyzing past sales, seasonal trends, and customer behavior, companies can predict demand more accurately, reducing errors by 20–50%. This leads to fewer stockouts, less overstocking, and better inventory management.

Key Takeaways:

- Stockouts hurt profits and customer loyalty: 91% of customers won’t return after encountering empty shelves.

- Overstocking ties up cash: Retailers hold $1.43 in inventory for every $1 in sales, leading to storage costs and waste.

- Modern tools improve accuracy: AI-driven forecasting cuts errors by up to 50%, reduces stockouts by 65%, and lowers inventory levels by 20–50%.

Historical data helps businesses identify patterns, correct data outliers, and separate normal demand from promotional spikes. Advanced methods like time series analysis, causal modeling, and machine learning make forecasts even more reliable.

"Accurate forecasting isn’t just a luxury - it’s a necessity for profitability and efficiency."

Read on to learn how to use historical data effectively and explore real-world success stories.

Data Science & Machine Learning for Demand Forecasting

Common Forecasting Problems in Inventory Management

Inaccurate forecasting can seriously impact business performance. For instance, the global retail industry loses a staggering $1.75 trillion each year due to out-of-stock items, which accounts for about 8.3% of total retail sales. These figures underscore the importance of using data-driven methods, particularly those grounded in robust historical data analysis.

How Stockouts and Overstocking Hurt Business

Stockouts can wreak havoc on customer loyalty and operational costs. When customers encounter empty shelves, 91% are less likely to return to that retailer. Beyond customer dissatisfaction, 43% of retailers report that stockouts lead to increased supply chain expenses, such as higher fees for expedited shipping and challenges with fluctuating inventory levels. A well-known example is Nike’s 2001 inventory mishap, which cost the company over $100 million. The issue? An oversupply of slow-moving designs paired with shortages of high-demand items.

Overstocking, on the other hand, is just as damaging. Retailers often hold $1.43 in inventory for every $1 in sales, locking up cash that could be better spent elsewhere. Excess inventory comes with its own set of costs, including storage, insurance, and the risk of products becoming obsolete or expiring. As Shopify puts it:

"Overstocking is when you have more inventory than you can sell. This can tie up your cash and prevent you from being able to invest in other areas of your business. Overstocking can also lead to spoilage if you have perishable items."

The financial toll doesn’t end there. Roughly 2-3% of inventory is lost to damages or expiration, and inventory mismanagement can cost individual stores up to $580 million in losses. Clearly, accurate demand forecasting isn’t just a luxury - it’s a necessity for keeping operations efficient and profit margins intact.

Why Forecasting Goes Wrong

Traditional forecasting methods often fall short for several reasons. Despite advancements in technology, 73% of supply chain leaders still rely on spreadsheets for planning and forecasting as of 2023. These outdated tools simply can’t keep up with the fast-paced and volatile nature of modern markets.

An industry expert highlighted the issue:

"Traditional forecasting falls short: Legacy tools can't handle the speed, price sensitivity, and trend volatility of today's fast fashion landscape."

Legacy systems struggle with rapid market changes and rely on rigid planning windows, making them ill-suited for sudden shifts in trends or the launch of new products without historical data. This results in forecast inaccuracies ranging from 20% to 50%, contributing to a global supply chain waste of $1.1 trillion. For small and mid-sized businesses, the stakes are even higher - nearly two-thirds reported losing 15% or more in revenue due to supply chain delays in 2022.

Traditional models also fail to account for external factors like economic shifts, competitor actions, and market trends. On top of that, they often overlook qualitative factors such as brand perception and customer sentiment. As one expert explained:

"One common pitfall that can lead to inaccurate forecasting is overreliance on historical data. While such data is valuable, using it alone can lead to inaccurate forecasts, especially in dynamic markets."

Overly complex forecasting models can also backfire, becoming error-prone and difficult to interpret. Without access to real-time data, businesses are left reacting to changes instead of anticipating them. Poor supply chain practices - like limited data sharing, inaccurate information, and misalignment across departments - only add to the problem.

These shortcomings in traditional forecasting methods highlight the need for better approaches. Leveraging historical data effectively can pave the way for more precise, data-driven forecasting models.

Using Historical Data for Better Forecasting

Historical data is the cornerstone of accurate demand forecasting. By diving into past sales figures, customer habits, and market trends, businesses can fine-tune operations and deliver better customer experiences.

This data holds the key to spotting patterns, understanding seasonality, and tracking shifts in consumer behavior over time. Such insights are essential for predicting future demand, identifying recurring trends, and preparing for sudden spikes or dips. Let’s break down how these methods can transform historical insights into actionable forecasting strategies.

Finding Seasonal and Repeat Patterns

Seasonal trends are among the most valuable takeaways from historical data. As Michelle Williams, Product Marketing Lead at Flieber, puts it:

"Seasonal demand refers to fluctuations in sales volume that generally repeat over a specified period of time."

Recognizing these patterns allows businesses to gear up for busy periods without overstocking inventory. For instance, holiday spending has grown by about 8% year over year, underscoring the importance of factoring seasonality into forecasts.

By identifying cycles in sales data, companies can better prepare for peak demand periods while avoiding unnecessary spending during slower times. Staying informed about current trends in seasonal demand forecasting also helps businesses adapt to changing consumer preferences.

Take the example of Ubique Group: their integration of seasonal forecasting tools led to a 15% improvement in fill rates and saved $10 million in operating inventory. Regularly monitoring and adjusting forecasts based on fresh data and market conditions is essential for staying ahead.

But seasonal forecasting isn’t just about spotting trends - it also involves addressing disruptions in the data.

Detecting and Correcting Data Outliers

Outliers can throw a wrench into any forecasting effort. These anomalies, if ignored, can distort results, mislead decision-making, and lead to poor inventory management. Nicolas Vandeput, a supply chain consultant, cautions:

"Outliers in supply chain data are more than mere statistical aberrations. These disruptive elements threaten to make your demand forecasts irrelevant, ultimately hindering supply operations."

Correcting outliers ensures businesses avoid over- or under-stocking, reducing the risk of tying up capital in excess inventory or running out of stock. Understanding the context behind the data - its sources, types, and peculiarities - is critical.

Advanced methods like machine learning algorithms (e.g., Isolation Forest) can identify anomalies with precision, while visualization tools like scatter plots and box plots help communicate these findings effectively.

Real-world examples show the importance of handling outliers. A pharmaceutical company, for instance, separated prescription demand from free samples, creating a clean dataset for better forecasting. Similarly, a manufacturing firm isolated a one-time government order from regular distributor demand, preventing the spike from skewing future predictions.

For known events causing outliers, businesses can separate demand streams or use specialized forecasting methods like event models or dynamic regression to account for these anomalies.

Separating Normal Demand from Promotional Sales

Promotional activities often create sharp demand spikes, which can distort baseline forecasts if not properly separated. With promotions driving $1 trillion in sales in 2023 and 87% of retailers planning to maintain or increase their promotional efforts, distinguishing between promotional and regular demand is crucial for inventory planning.

The challenge is amplified by the fact that 37% of retailers in the U.S., U.K., France, and Germany still rely on spreadsheets for managing promotions, making it difficult to analyze their full impact.

Historical data helps businesses understand how past promotions affected demand, enabling them to adjust forecasts and develop contingency plans for future changes. For example, a grocery store running a promotion on one brand of organic ground beef (HappyCow) can use advanced systems to analyze how the promotion affects not only HappyCow’s sales but also those of a competing brand, GreenBeef. These systems can then adjust orders accordingly - reducing GreenBeef inventory to prevent spoilage while increasing HappyCow stock to meet demand.

Modern supply chain solutions also allow planners to configure how early promotional inventory should be delivered and how much of the demand should be allocated to these early shipments. Moving away from manual spreadsheets to automated tools simplifies the complexities of today’s retail strategies while keeping promotional and baseline demand clearly separated.

Methods for Data-Driven Demand Forecasting

Getting demand forecasts right starts with picking the right method to analyze historical data effectively. Once the data is cleaned, selecting the proper approach is crucial, as different methods suit different business needs and data complexities. Interestingly, companies using time series forecasting techniques grow 19% faster than those relying purely on intuition. Let’s dive into three key methods that turn historical data into actionable forecasts.

Time Series Analysis for Trend Prediction

Time series analysis breaks data down into components like trends, seasonality, and noise. The process often begins by identifying long-term patterns through rolling averages, which help smooth out short-term fluctuations. For instance, studying monthly demand might reveal both overall growth trends and recurring seasonal peaks.

Autocorrelation analysis can confirm seasonality by identifying strong correlations at specific intervals, such as a 12-month lag. Popular techniques like moving averages, exponential smoothing, and decomposition methods isolate these patterns, while spectral decomposition pinpoints recurring frequencies. These insights are especially useful for improving inventory management by aligning stock levels with demand cycles.

Causal Modeling for Better Understanding

Unlike time series analysis, which focuses on internal data patterns, causal modeling brings external factors into the equation. This method incorporates variables like economic indicators, promotional efforts, and market trends to identify cause-and-effect relationships. Over fifty years ago, Harvard Business Review highlighted the importance of causal forecasting in uncovering these relationships.

Causal modeling also supports scenario analysis, enabling businesses to test how changes in key drivers might impact outcomes. This approach can lead to measurable gains, such as reducing inventory costs by up to 10%. By connecting external influences to demand, companies can better align their strategies and resources.

Adding Machine Learning to Forecasting

Machine learning takes demand forecasting to the next level by analyzing diverse data sources to uncover complex, non-linear relationships. Companies using AI-driven forecasting have seen forecast errors drop by 30% to 50%, stockouts decrease by up to 65%, and inventory levels shrink by 20% to 50%.

A standout example is Lennox Residential, which uses advanced machine learning algorithms and cluster analysis to identify seasonal patterns across its product range. By analyzing over 200 micro-climates within the U.S. and thousands of SKU-location combinations, Lennox boosted service levels by 16% and increased inventory turnover by 25%.

Machine learning models excel at predicting weather-driven demand shifts up to two weeks in advance and managing promotional events with precision. They can distinguish between demand cannibalization and genuine growth while identifying subtle shifts in consumer sentiment that signal changes in buying behavior . These models continuously learn and adapt in real time, processing vast amounts of data to uncover hidden patterns. This ability to evolve with new information makes them indispensable in today’s fast-changing markets . Their application not only sharpens forecasting accuracy but also streamlines inventory management.

sbb-itb-499c055

Adding Historical Data to Forecasting Systems

Incorporating historical data into forecasting systems involves a structured approach divided into three key phases. These steps ensure predictions are as accurate as possible. The first step is preparing and cleaning your data - a critical foundation for reliable forecasting.

Data Preparation and Cleaning

Accurate demand forecasting starts with thorough data preparation. Did you know that data quality issues are responsible for about 62% of forecasting errors? Companies that prioritize strong data quality measures can reduce these errors by up to 37%.

The process begins by identifying all relevant data sources. This might include ERP systems, CRM platforms, sales records, and even external market trend data. Defining the time horizon and analysis frequency is equally important. Experts often recommend using at least 24 months of historical data to capture seasonal and cyclical trends effectively.

Cleaning the data is where things get meticulous. Start by removing outliers and correcting missing values or inconsistencies using statistical tools. However, it’s vital to preserve anomalies that reflect genuine market conditions. Next, standardize the data - convert different units, currencies, and scales into a unified format.

External factors also play a big role in shaping demand patterns. Elements like economic conditions, market trends, promotional campaigns, and seasonal changes significantly influence customer behavior. Adjusting for these factors, such as calendar effects and seasonal variations, helps create a more accurate baseline for forecasts. Finally, use descriptive statistics and exploratory data analysis to uncover patterns, variations, and correlations in your data. Validating this information against market research, customer feedback, and industry benchmarks ensures it’s both reliable and actionable.

Picking the Right Forecasting Model

Once your data is clean, the next step is choosing a forecasting model that aligns with your business needs. The choice of model depends on your data's characteristics, your objectives, and the resources at your disposal.

Time series models are a popular choice when you have consistent historical data spanning at least two years. For businesses with clear seasonal or cyclical trends, models like SARIMA (Seasonal Autoregressive Integrated Moving Average) or seasonal decomposition methods are particularly effective. In more stable markets, ARIMA models are great for monthly sales forecasting, while exponential smoothing methods work well in rapidly changing conditions.

Machine learning algorithms, on the other hand, are perfect for handling complex scenarios involving multiple variables. These algorithms can identify non-linear relationships and interactions that traditional models might miss. To ensure your model performs well, evaluate it using metrics like Mean Squared Error (MSE), Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and Mean Absolute Percentage Error (MAPE). Cross-validation techniques, such as rolling window cross-validation, can further enhance consistency. Industry-specific insights also play a crucial role in picking the model that best suits your unique challenges.

Ongoing Testing and Model Updates

Even after selecting a model, the work doesn’t stop. Continuous monitoring and updates are essential to maintain accuracy. Over time, forecasting models naturally degrade as market conditions shift and customer behaviors evolve. Regular updates - monthly, for example - can significantly improve results compared to static models.

Setting up regular data refresh cycles, whether weekly or monthly, ensures your forecasts reflect the latest trends and seasonal changes. Comparing forecasts against actual outcomes as new data becomes available helps identify areas for improvement.

"A forecast based on average past demand is only as reliable as the historical data it analyzes." - forecastio.ai

To keep models reliable, monitor key metrics like forecast accuracy, error rates, and prediction confidence levels. When performance dips below acceptable thresholds, it’s time to retrain the model. Watching for data drift - shifts in statistical patterns, customer behavior, or market trends - can also signal when updates are needed. Automated systems can detect these shifts and alert your team to intervene.

A/B testing is a practical way to validate retrained models before rolling them out fully. By running new models alongside existing ones, you can confirm their effectiveness without risking disruptions. Adopting an MLOps approach can further streamline the process, automating updates and ensuring your forecasting systems stay aligned with evolving business needs.

Case Studies: Success Stories with Historical Data

Real-world examples highlight how using historical sales data can improve forecast accuracy, reduce costs, and increase profitability.

Retail Improvement with SKU-Level Forecasting

Here are some specific examples of how historical data has transformed inventory management decisions.

Urban Retail Collective faced a familiar challenge: managing inventory across multiple locations with fluctuating demand patterns. Their traditional forecasting methods often led to stockouts and overstocking, which hurt both customer satisfaction and profit margins.

To address this, they adopted an AI-powered demand forecasting system that analyzed historical data at the SKU level with daily, weekly, and monthly granularity. This system integrated data from various sources, including POS records, inventory levels, promotions, seasonality, weather, local events, and pricing.

The results were impressive: stockouts dropped by 72%, excess inventory decreased by 31%, SKU-level forecast accuracy jumped from 67% to 91%, and annual markdown losses were reduced by $2.3 million. These changes significantly improved their gross margin and ROI.

"The demand forecasting system has turned our inventory management into a precise science. We can now anticipate shifts in demand patterns before they happen and position our inventory accordingly. The system's ability to incorporate external factors like weather and local events has been particularly valuable. This has been a game-changer for our profitability and customer satisfaction."

- Thomas Reynolds, VP of Supply Chain, Urban Retail Collective

Similarly, Shoeby, a retailer with 240 stores, faced challenges with manual stock optimization. After implementing an AI-driven SKU-level forecasting solution, they saw a 4% increase in inventory turnover, a 2% reduction in end stock, and a 3% growth in total revenue.

Using Historical Data for Supply Chain Efficiency

A national home improvement retailer tackled inventory challenges by analyzing 24 months of SKU data through a two-phase forecasting system. This approach factored in past sales trends, seasonal variations, and external influences, allowing them to optimize inventory levels across their network.

The outcome? Their first-time repair rate surged from around 50% to over 90%, while inventory levels dropped by 37%, leading to nearly $800,000 in annual savings.

Walmart offers another compelling example of how historical data can optimize supply chains. The company uses AI-driven systems to align holiday stock across its network. These systems identify and correct supply chain discrepancies while adjusting for regional customer preferences.

"By leveraging historical data and pairing it with predictive analytics, we're able to strategically place holiday items across distribution and fulfillment centers, and stores, streamlining the shopping process."

- Parvez Musani, Sr. Vice President, E2E Fulfillment, Walmart

Walmart's system even includes a unique feature that "forgets" anomalies, ensuring that one-off events don't distort long-term forecasting accuracy. This approach keeps their inventory management sharp and adaptable.

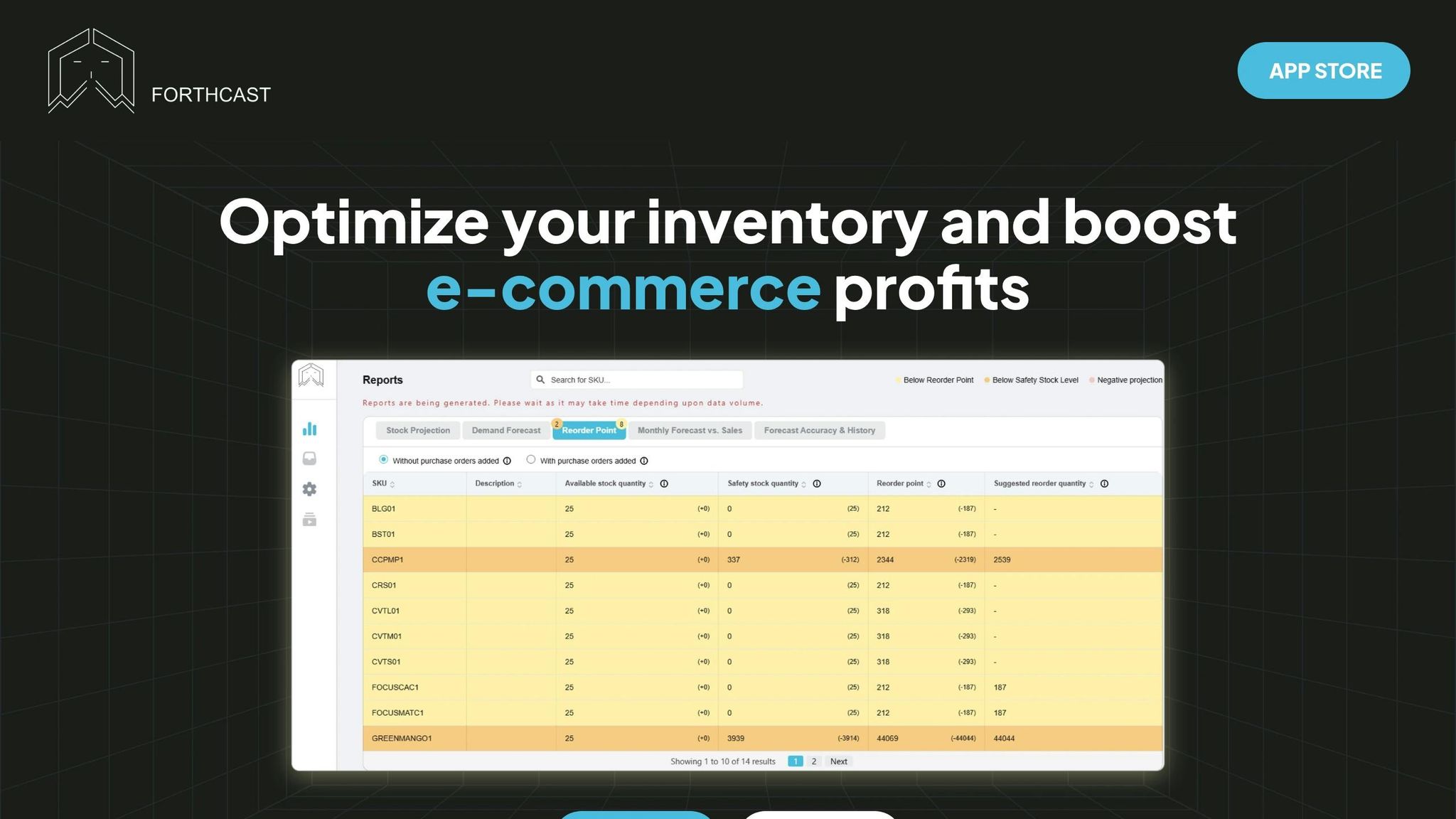

These examples pave the way for advanced platforms like Forthcast to further refine inventory forecasting.

How Forthcast Delivers Data-Driven Results

Building on these successes, Forthcast takes historical data analysis to the next level, offering businesses powerful tools for precise demand forecasting. The platform combines statistical techniques with machine learning to analyze historical sales data, uncover patterns, and generate highly accurate forecasts.

Forthcast captures a wide range of data, including lead times for individual items, anomaly detection for unusual events, and SKU-level breakdowns. It also provides robust metrics to measure both bias (the direction of errors) and accuracy (the size of errors), ensuring continuous improvement in forecast quality. By blending statistical analysis with machine learning, the platform delivers optimal forecasting results.

Businesses using advanced forecasting tools like Forthcast typically see reductions in excess inventory ranging from 15% to 25%, all while maintaining or improving service levels. On top of that, automation-driven labor productivity gains often fall between 30% and 60%, freeing teams to focus on strategic planning rather than manual data crunching.

Conclusion: The Power of Historical Data

Historical data plays a critical role in improving demand forecasting and optimizing inventory management. When companies analyze past sales data effectively, they can see tangible benefits like better forecast accuracy, cost savings, and increased profitability. For instance, Retailer ABC improved forecast accuracy by 20% and reduced stockouts by 15% through deeper analysis of historical sales trends. Similarly, Manufacturer XYZ saw a 25% boost in forecast accuracy and streamlined its production process. These examples highlight how leveraging historical data can create a solid foundation for advanced tools like Forthcast to deliver actionable insights.

Top-performing companies illustrate how historical data can transform operations. Take Walmart, which uses past sales trends to forecast demand across its vast product range. This approach not only reduces stockouts but also minimizes excess inventory and improves inventory turnover.

For businesses still relying on manual methods like spreadsheets, transitioning to AI-driven forecasting can cut costs by 10%–15% while significantly improving accuracy . This shift represents a huge opportunity for companies ready to embrace data-driven strategies.

By consistently applying historical data, businesses can achieve ongoing improvements in forecasting. Whether it’s identifying seasonal patterns or automating model updates, historical data informs every step of the process. To stay ahead, companies must keep their data up-to-date, use multiple forecasting methods for better accuracy, and track performance regularly to adapt to shifting market trends. Combining automated data collection with statistical models and machine learning creates a robust framework for long-term forecasting success.

"Accurate inventory forecast is invaluable, especially in times when supply chains and consumer demand are changing rapidly. Getting forecasts right requires a mix of data analysis, experience in the industry and customer insights to metaphorically peer into the crystal ball and predict future demand."

– Abby Jenkins, Product Marketing Manager, NetSuite

Forthcast exemplifies this evolution by blending statistical analysis with machine learning to turn historical sales data into practical insights. Its features - like tracking lead times for individual items, spotting anomalies, and offering SKU-level analysis - help businesses move beyond basic spreadsheets to achieve precise, automated demand planning.

As the competitive landscape shifts, inventory management software is expected to grow at a 5% CAGR between 2023 and 2032. Companies that embrace historical data analysis now will be better equipped to navigate market uncertainties, anticipate changes, and adapt their strategies. The real question is no longer if businesses should use historical data but how quickly they can implement the tools and processes needed to unlock its full potential.

In today’s unpredictable markets, historical data serves as a guiding light, enabling smarter decisions that enhance efficiency and customer satisfaction. The businesses leading tomorrow will be those investing in data-driven forecasting today.

FAQs

How can historical data differentiate regular demand from promotional sales in forecasting?

Historical data is key to understanding the difference between everyday demand and sales driven by promotions. By examining past sales trends, businesses can identify patterns - like surges during promotional events - and separate these from regular buying habits.

This understanding allows businesses to create more precise demand forecasts. They can factor in the short-term effects of promotions while keeping a clear picture of the usual demand. With this clarity, companies can manage inventory more effectively, avoiding stockouts during busy periods and steering clear of overstocking once the promotion wraps up.

What challenges do traditional forecasting methods face, and how can modern tools help solve them?

Traditional forecasting methods often stumble over a few key hurdles: they tend to rely too heavily on historical data, often overlook external factors, and struggle to keep up with sudden market shifts. Take past sales data, for instance - it’s useful, but when it ignores changes in consumer preferences or unforeseen events like supply chain hiccups, forecasts can go off track. The result? Stockouts, overstocking, and revenue losses.

Enter modern tools powered by AI and machine learning. These technologies take forecasting to the next level by diving into a much broader pool of data. They analyze real-time market trends, customer behaviors, and external factors like economic changes. This approach doesn’t just refine forecast accuracy - it empowers businesses to avoid stockouts, cut down on surplus inventory, and make smarter, data-driven decisions that enhance supply chain efficiency and profitability.

Why is it essential to regularly update and test demand forecasting models?

Keeping your demand forecasting models up-to-date and regularly testing them is crucial for staying accurate and adjusting to shifting market dynamics. Factors like changing consumer preferences, seasonal patterns, and external influences - such as economic fluctuations - can all impact demand. That’s why it’s essential to continually feed your models with the most current data.

Frequent updates and testing allow businesses to spot and address biases, sharpen forecast accuracy, and minimize the chances of stock shortages or excess inventory. This not only helps maintain optimal inventory levels but also ensures customers find what they need, when they need it. In the end, precise forecasting supports smarter decisions and smoother operations.